Your Future SIPP

Your SIPP of Choice

An award winning and flexible product designed to provide flexibility with a wide range of investment options and a competitive entry level annual fee. Future proof your recommendation from day one

YOUR FUTURE SIPP

The only SIPP your clients will ever need, both pre & post retirementSetting up a SIPP has never been easier – with our online SIPP set up, you can establish the SIPP, request transfers, and invest via your preferred investment solution with no paperwork or wet signatures. And with our auto investment functionality, all cash can be invested with your preferred solution automatically.

We understand that transparency and affordability are important to you and your clients. That’s why we offer a menu-based fee structure, so your clients will only pay for what they use. We also settle invoices directly from the pension, making the process seamless and hassle-free.

Fee Deals

We’ve made it even easier for you to recommend Curtis Banks to your clients, with exclusive offers on Your Future SIPP.

To find out how you could save your client over £1,000, get in touch with one of our Business Development Managers.

Investment options

Unparalleled flexibility and choiceAs one of the UK’s largest independent SIPP providers Nucleus has over 275,000 clients and £101.6 billion of assets under administration, giving us the scale and expertise to meet your needs. With access to over 200 investment partners, fixed term deposit accounts and cash platform solutions including Insignis, we offer unparalleled flexibility and choice.

How to Apply

Applying for Your Future SIPPWatch our short animated video for Financial Advisers to find out the steps involved in setting up a new Your Future SIPP plan with Curtis Banks.

Our Fees

Clients only pay for what they useWe understand that transparency and affordability are important to you and your clients. That’s why we offer a menu-based fee structure, so your clients will only pay for what they use. We also settle invoices directly from the pension, making the process seamless and hassle-free.

You can find our Schedule of Fees below.

Start your clients YFS journey

Key Features

In creating Your Future SIPP we have listened to our clients and advisers and included as standard the key features that matter most to you.

- Access to Curtis Banks’ high quality administration

- Direct access to commercial property, including borrowing, succession planning and part/joint purchase

- Auto adviser charging

- Access to nearly all UK platform, broker and discretionary fund managers

- No minimum investment

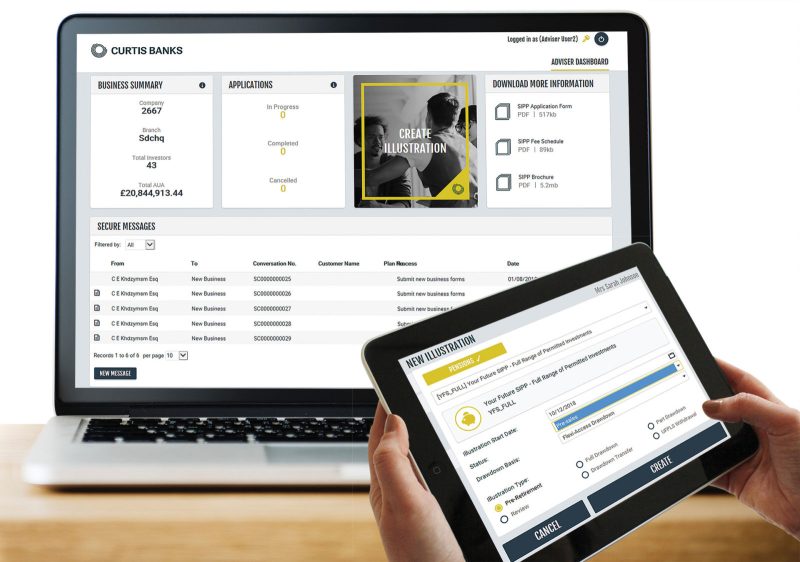

- Modern, functional online portal, completely responsive to any device to access on the go

- Full suite of retirement options allowing clients to take advantage of the pension freedoms flexibility

- Fully consolidated annual statement

Our online portal is completely responsive to any device to access on the go, and we continue to deliver a scheduled program of additional functionality, to continually enhance your user experience.

Contact us

Via our portal

Please send us your forms and instructions securely by using our convenient and encrypted messaging feature on the Curtis Banks portal.

Access PortalVia email

If you'd like to send us an email, please search our Contact page to find the relevant contact details.

Contact PageVia phone

If you'd like to speak directly to a member of our team you can call us on 0370 414 7000

Call us